In the era of the energy transition, questions of state control and power are back on the agenda in a big way. All of these dynamics are coming to the fore now, particularly as the US and the EU – seeking to lessen their industries’ dependece on Chinese actors – pursue various state policies to gain greater access and control over the so-called transition minerals. This longread examines some of the tensions the Indonesian state is facing along with its contradictory policies as it seeks to navigate these challenges.

Introduction

In the era of the energy transition, questions of state control and power are back on the agenda in a big way. In the midst of increasing geo-political and geo-economic tensions between the US and China, states that hold resources key to de-carbonisation technologies (e.g. the copper in wind-tubines, the nickel and lithium in electric vehicle batteries) are grappling with whether and how they can leverage their position. Last year, Mexico nationalised its lithium industry, Zimbabwe has banned the export of unprocessed lithium and just recently Chile’s left-leaning President Gabriel Boric has announced an increased role for the state in the national lithium industry there. The Indonesian state is similarly testing the waters with its curbing of exports of raw minerals.

These resource-holding states are attempting a careful balancing act. At the most general level, all states under capitalism face the challenge of on the one hand ensuring the continued expansion of capital accumulation within their territories, while on the other hand retaining a minimum level of social legitimacy towards their populations. Particularly when it comes to mining, these two goals are often at logger-heads: the expansion of the mining industry typically comes with significant social and ecological costs. As if that weren’t enough, these states – especially the poorer ones – are also grappling with questions of national industrialisation and how to balance the relations between foreign and national capital. States that dare to place requirements on foreign as well as national capital in industries like mining face immediate threats of capital flight – as the Financial Times reported in the first sentence of its coverage of Chile, the government’s decision was “creating uncertainty for investors(external link)”. With regards to Mexico the same paper wrote on June 5, 2023(external link): ‘ The mining code changes, which includes making it more challenging for companies to obtain mineral concessions, threaten to trigger a wave of litigation by Canadian miners invested in the country’. Furthermore, inter-state conflict and collaboration also impacts on individual state’s management of this balancing act.

All of these dynamics are coming to the fore now, particularly as the US and the EU – seeking to lessen their industries’ dependence on Chinese actors – pursue various state policies to gain greater access and control over the so-called transition minerals. The following piece examines some of the tensions the Indonesian state is facing along with its contradictory policies as it seeks to navigate these challenges. It covers, firstly, the potential manoeuvring room for national industrialisation plans that the energy transition and geo-political rivalry is opening up. It then turns to how any such room to maneuver is challenged by the existing international trade and investment regime and furthermore how this trade and investment regime is currently being deepened by examining the case of EU-Indonesia economic relations. The piece closes with some challenging questions for social movement forces in Indonesia and beyond.

Critical Minerals at a critical time

Indonesia’s policy ban on raw mineral exports has recently been in the world’s spotlight. This policy was issued in the midst of geopolitical tension between the US and China, particularly in a competition to secure the supply chain of critical minerals to meet the needs of future global industry trends, namely the digital and green technology-based energy industry.

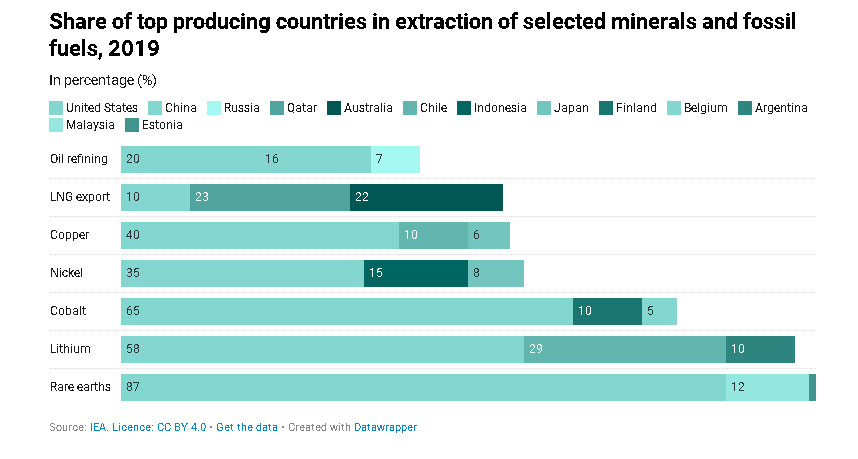

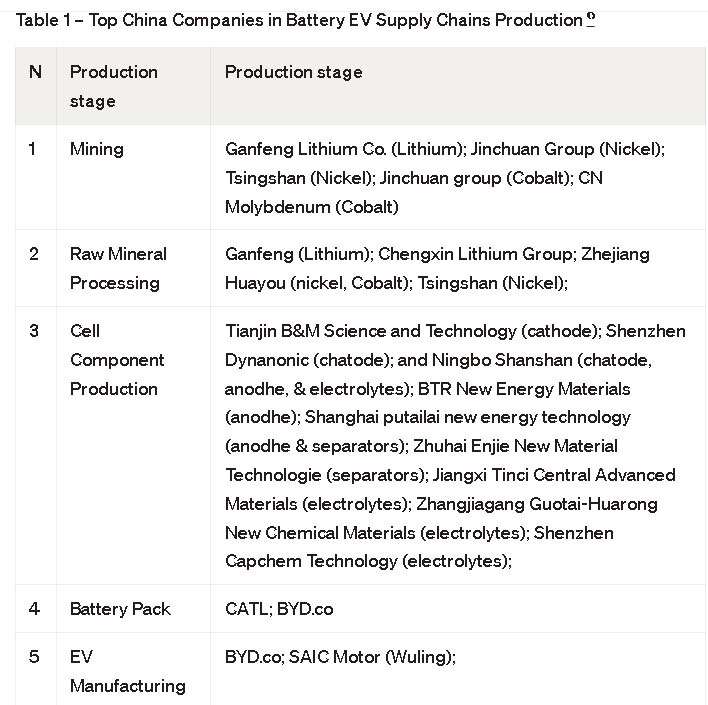

US-China trade tensions, the Covid-19 pandemic, and the current war in Ukraine have disrupted global supply chains, raising the question of access to and control of transition minerals. The disruption is caused by the significant dependence of global trade on transition minerals production supplies concentrated in just one or two countries, especially China. For example, the Democratic Republic of the Congo (DRC) and People’s Republic of China (China) were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively in 2019, and in the processing operations Chinese companies’ share of refining is around 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth element.1 (See the top Chinese companies in EV supply chains in Table 1)

Indonesia’s strategy is to take an important role in supply chain activities for global electric battery production, in particular for electric vehicles (EVs). The Indonesian government set this as a priority for its industries in 2019. On 21 December 2022, President Joko Widodo re-announced a ban on bauxite exports, which would take hold in June 2023, requiring instead that the mineral is processed and refined in the country. This was the latest policy move of a series of decisions which can be traced back to 20142, when Indonesia banned the export of raw minerals3 and Nickel ore in January 20204. In the future we can expect several more Indonesian Government policies regarding the export of other raw mineral commodities such as copper and tin.

Over the past three years, Indonesia has become one of the vortices of competition for access to the minerals that the world needs today, especially for advanced industrial countries that are looking for strategies to guarantee critical mineral supplies from outside China. The International Energy Agency (IEA) report on the Role of Critical Minerals in Clean Energy Transition (2021) states that mineral production and processing is concentrated in just three big producer countries, and this has the potential to cause supply vulnerability due to political instability, geopolitical risks, and possible export restrictions. For example, rare earth elements are sequentially only controlled by China, the United States and Myanmar; while lithium is sequentially controlled by Australia, Chile, and China; and Nickel is respectively controlled by Indonesia, the Philippines, and Russia5. (See graph 1)

graph 1

With large reserves of nickel and several critical minerals for EV battery production, the Indonesian state is increasingly confident in its efforts to move forward with the national industrialization agenda as set out in the 2015-2035 National Industrialization Development Master Plan.

In the inauguration speech for his second term in 2019, President Joko Widodo committed to pushing for Indonesia’s economic transformation in the next five years of his leadership until 2024. Consequently, an export ban policy to increase the added value of production has been in place since then. This change in national economic policy aims to transform Indonesia from an exporter of raw materials to an exporter of highly competitive products through downstream industry, particularly those based on natural resources. The economic transformation agenda is outlined in the Narrative of the 2019-2024 National Medium-Term Development Plan (RPJMN)7.

The RPJMN is the government’s strategy for the post-2008 crisis situation that continued to worsen, only to be exacerbated by the outbreak of the Covid-19 Pandemic. The country’s current account deficit is worsening due to Indonesia’s dependence on trade based on raw natural resource commodities. The decline of global prices and demand for raw commodities have failed to boost state revenues and have resulted in dependence on imports, especially on industrial raw/auxiliary materials, in the domestic market. Therefore, the government claims that downstream industry based on natural resources will be able to stop dependency and increase domestic consumption and limit imports as a way to survive in a crisis situation. All this will also strengthen the national economy.

The legal underpinning of nationalisation

One might imagine that the Indonesian government’s decision to downstream nickel and several other mineral commodities is merely a response to the rather recent trend of increasing global mineral demand for a green transition. However, the Indonesian government took the decision a decade ago, ostensibly to fulfil the Constitutional mandate that “natural wealth is owned by the state and used for the welfare of the people”. Following this mandate, however, necessitates the passing and implementation of laws and legal instruments to carry it through, and Indonesia has passed a series of these towards that end.

Wicaksana (20199) contends that the Government of Indonesia has used Article 33 of the 1945 Constitution10, which partly stipulates that important sectors of production that affect the lives of many people should be controlled by the state, as its justification for passing these laws. This has been true since the era of Soesilo Bambang Yudhoyono’s leadership that carried out the model of economic nationalism, which was then continued by President Jokowi. Furthermore, Warburton’s analysis (201811) emphasizes that there is a general trend toward greater state intervention in the resource sectors, and increased limitations on foreign investment as an effort to strengthen the economic positions of nationals and the nation. In the Indonesian context, Warburton argued that Indonesia earned a reputation as a country marked by ‘resource nationalism’ during the global commodity boom, which took place roughly from 2003 to 2013. She then organises nationalist policies into two categories: localising resource nationalism,12 and industrialising resource nationalism13.

After the first wave of resource nationalism during the Soekarno’s era, Indonesia passed the Mining Law 4/2009, which was issued during the Yudhoyono presidency. The law required mining companies to process and refine mining products in the country prior to export, to increase the added value of mineral commodities14 In addition, another section of the law also aims to nationalize foreign mining companies. It effectively obliges foreign-owned mining industries to progressively divest to become minority shareholders within five years15. Those shares are to be transferred to the Indonesian government through State owned enterprises or local industries – such that within ten years 51% of shares are owned by Indonesian nationals16. Similar obligations and requirements have been reaffirmed in the new Mining Law No.3/2020, which amends Mining Law 4/2009. In addition, the government included an obligation to renegotiate contracts of work for foreign mining companies to comply with applicable local laws17.

Critical Corporate Resistance

These laws can be understood as an effort on the part of the state to support and develop ‘local’ capitalist firms, by seeking to put some degree of restraint on foreign capital active within the Indonesian territory. However, such efforts rarely go unchallenged. Since 2013, there have been several lawsuits, particularly by foreign mining corporations, to revise and cancel these policies. Most of these attempts have failed so far and the Government of Indonesia continues to guarantee the implementation of the domestic processing obligation of raw minerals in Indonesia prior to export in accordance with the mandate of the 1945 Constitution. However, a close look at these lawsuits gives some helpful insight into the kind of resistance Indonesia is up against.

In 2014, nine mining companies in Indonesia filed a Judicial Review lawsuit to the Constitutional Court18, against specific Articles of the Mining Law 4/2009, in particular those related to domestic beneficiation of mining products. However, the Constitutional Court rejected the lawsuit, and argued that the Articles were in accordance with the constitution. For the Court, the argument put by the applicants (i.e. mining companies) had no grounds, as the law provided the applicants sufficient time in the transitional period to carry out domestic processing and refining. Mining companies had to carry out the refining obligation no later than five years after the promulgation of the Law. The Court also concluded that mineral and coal resources, and other natural resources, are controlled by the state, and the state has the right to regulate mineral and coal resources for the greatest prosperity of its people.

Another instance of foreign mining investors challenging this Indonesian policy was a lawsuit filed by Newmont (Nusa Tenggara Partnership BV), a US Mining Company registered in the Netherlands, to the International Centre for Settlement of Investment Disputes (ICSID) in 2014 through the use of the Indonesian-Dutch Bilateral Investment Treaty (BIT)19. The lawsuit was based on Newmont’s argument that the export ban of raw minerals was not in accordance with the signed Contract of Work20. Ultimately, Newmont withdrew the lawsuit after an agreement was reached by both parties, which agreed to start a renegotiation process on the Contract of Work. In another example, centred around the requirement for the divestment of foreign shares and the obligation to process raw minerals, was the threats by Freeport McMoRan, a US mining company, to sue Indonesia and take the case to ICSID21. These two lawsuits put forward by the US corporations were facilitated through an international investment dispute mechanism called Investor to State Dispute Settlement (ISDS).

ISDS is a mechanism included in (bilateral) investment treaties or in investment chapters of free trade agreements that allows multinational corporations to sue governments in international ad-hoc tribunals if they can claim that domestic laws reduce the value of their investment. It is a one-sided and undemocratic system in which the state is always a defendant and cannot bring counter-claims against investors to the same tribunals. ISDS by-passes national jurisdictions. It gives special privileges and rights to foreign investors, giving them more power relative to citizens and governments.Around the world, ISDS mechanisms have bolstered corporate impunity, while undermining state power to regulate the practices of corporations. They have often left the state as a hostage to investors’ interests, and allowed corporations to sue for billions of dollars of compensation when they can claim that national policies in some way harm their investments22. In the end, the state pays compensation using public money, raising important questions about the balance between private gain and public loss. Moreover, the mechanism has a regulatory chill effect that can prevent the state from legislating to protect people’s rights. Certainly, as the export of more raw minerals is banned by the Indonesian government, the country will more than likely face various threats of ISDS lawsuits from foreign investors – and, it should be noted, the ISDS-mechanism is also open to local companies as long as they have registered a mailbox company abroad where a Bilateral Investment Treaty guarantees access to such a mechanism.In 2015 Indonesia cancelled many of its Bilateral Investment Treaties after it had been sued by in particular mining corporations and started to develop alternative investment protection proposals based on exhaustion of local remedies and alternative forms of dispute settlement.

Inter-State conflicts

Beyond these state-capital conflicts over the nationalisation agenda, there are also state-state conflicts, such as the European Union’s lawsuit against Indonesia at the World Trade Organization (WTO) regarding the policy on nickel export restriction. Although Ha-Joon Chang (200323) argued there is still room for manoeuvre for developing countries like Indonesia to impose industrial policies that can be used perfectly legitimately under the World Trade Organization (WTO) regime, he also argued that the ongoing disputes at the WTO on what is free and fair trade, including the unfair competition among the members, will not go away easily given the formal ‘democratic’ decision-making structure of the WTO.

The case in question was filed by the European Union on 22 November 2019, by submitting a request for consultation against Indonesia at the WTO Dispute Settlement Body. The European Union claims that Indonesia’s imposition of measures to prevent the export of nickel ore- achieved through various laws and regulations as outlined above- is inconsistent with the WTO General Agreement on Tariffs and Trade (GATT).

The WTO Panel’s decision supported the European Union over Indonesia, with the Panel concluding that Indonesia’s measures to limit exports and domestic processing requirements of Nickel ore had contradicted Article XI:1 GATT 1994 (See Box-1). However, Indonesia’s efforts to defend the policy have not stopped, and on December 8, 2022 the Government of Indonesia submitted an Appeal to the WTO Dispute Settlement Body.

The domestic processing obligation strategy (pushed from the Indonesian side) is an important policy for developing countries to realise sovereign economic development. It has the potential support national industrialisation efforts and to potentially disrupt historical trade patterns that rely heavily on the export of primary commodities, usually with little resultant economic development to show for them. The conclusion of the WTO Panel confirms that state sovereignty continues to be challenged as shown here, where the rules of international trade agreements trump the Indonesian Constitution that grants the state control of its own natural resources.

In its defense, Indonesia used Article XI:2 (a) of the GATT as an argument to strengthen the implementation of both policies: the export prohibition and the domestic processing requirement on nickel products. The article allows WTO members to ban or restrict exports to prevent or relieve critical shortages of foodstuffs or other products essential to the exporting contracting party.Indonesia put forward three reasons why Nickel ore is important for its national industry so that the government has to impose export restrictions on Nickel products. First, the importance of mining for the Indonesian economy, accounting for a substantial portion of its GDP. In this regard, the state notes that Indonesia is a top nickel producer in the world accounting for 7% of global output, and nickel mining contributes significantly to government revenue and to employment while being of particular economic and strategic significance in the impoverished regions where it is produced, such as Sulawesi and Maluku. Second, Indonesia argues that nickel is an indispensable input for the steel industry which accounts for 3.94% of total industrial GDP. Indonesia notes that the domestic steel industry is not able to meet demand and that nearly half of Indonesia’s demand for steel is supplied from abroad. Third, Indonesia points to the implementation of a strategic plan to expand EV battery production in Indonesia in the short term, which results in a need to secure a critical input for such production, i.e. nickel. These three reasons referred to the jurisprudence of the China-Raw Materials case related to China’s bauxite export restrictions to meet the needs of its steel industry.However, in its consideration, the WTO Panel explained that in order to be able to categorize Indonesia’s policies as meeting the criteria in article XI: 2 (a) of the GATT, Indonesia must be able to prove that all of its elements have been met. In the context of nickel ore as an essential product, the Panel did not exclude the possibility that actions within the scope of Article XI:2(a) GATT 1994 may relate to natural resources that are depleted. However, Indonesia must show that its actions are related to critical (emphasis added) shortage elements. In relation to this element, the WTO Panel stated that they did not see any similarity in the situation between the Bauxite restriction case in China and the Nickel restriction case in Indonesia.According to the WTO Panel, Indonesia’s policy measures are not designed to address a critical shortage of nickel ore for the mining industry. Production of electric vehicle batteries has not yet started in Indonesia and is only projected to become a source of employment and income for the Government of Indonesia in the future. For the WTO Panel, Indonesia has failed to prove that Indonesia’s nickel ore export restrictions comply with the elements of Article XI:2 (a) GATT. Therefore, the Panel concluded that the ban on exports and the obligation to process domestically for Indonesian nickel ore products cannot be exempted from the obligations in Article XI:1 GATT 1994.

Angering the big guns, at odds with the EU

As shown above, Indonesia’s attempts to keep raw materials in the country and to only export them after beneficiation have not been without resistance. Going forward, it is possible to pinpoint other points of contention that will arise, in particular clashes with powerful international trading partners who have counted on unrestricted access to Indonesia’s raw materials. One example that demonstrates this, is Indonesia’s engagement with the European Union (EU).

Recently, the EU announced the Critical Raw Materials Act to ensure that the EU has access to a secure and sustainable supply of critical raw materials which are crucial for the green energy transition24. International trade cooperation is an essential part of this strategy to support the overarching agenda of diversifying the EU’s supply of critical raw materials, and this is where a decision in the EU will greatly impact Indonesia. The EU aims to achieve its goals by expanding its free trade agreements, strengthening the World Trade Organization (WTO) rules, particularly to ensure the enforcement against unfair trade practices, expanding its network of Sustainable Investment Facilitation Agreements, including to seek mutually beneficial partnerships with emerging markets and developing economies under the framework of the Global Gateway Strategy25.

The EU aims to increase trade cooperation with several strategic countries, such as Indonesia, Chile, Mexico, New Zealand, Australia and India. In this context, where the EU seeks to secure alternative and guaranteed sources of raw materials, the European Union’s lawsuit at the WTO against Indonesia’s nickel export restriction policy makes more sense. It was one of the EU’s strategies to combat the export restrictions that have nullified and impaired the benefits accruing to the EU under the WTO agreement.

Various aspects of the EU’s slew of trade agreements pose problems for Indonesia’s policy: many agreements have a dedicated Energy and Raw Materials chapter, which includes clauses such as predictable impact assessment procedures or non-discrimination treatment for investors in third countries. Furthermore, some recently concluded Energy and Raw Materials (ERM) chapters of EU Free Trade Agreements contain specific sustainability provisions, designed to comply with the EU commitment to high sustainable and human rights standards, which may place a large burden on countries such as Indonesia. Some EU trade agreements have a separate chapter on trade and sustainable development that binds the trading partners to international agreements and standards of human rights, decent work, the climate and the environment.

The presence of the EU Critical Raw Materials Act will provide challenges in discussing trade cooperation between Indonesia and the EU, especially related to the Indonesia-EU Comprehensive Economic Partnership Agreement (IEU-CEPA). The completion of the IEU CEPA negotiations, which are still ongoing, will be an important step for the EU to implement its agenda to secure access to critical raw materials.

For seven years, the IEU CEPA negotiations have faced various obstacles, especially related to certain incompatibilities between the economic policies of the EU and Indonesia. Indonesia is protesting the EU environmental regulations that have the potential to hinder market access for several commodities, such as palm oil and other forest products. On the other hand, the European Union also has several objections to Indonesia’s policies, especially those related to investment and export restrictions of Indonesian raw materials26.

Although the EU is committed to building strategic partnerships on critical raw materials value chains by supporting the in-country value-creation of the third-country partners, it is still unclear how the EU will do this with Indonesia. This is considering that Indonesia also has ambitions to develop its own renewable energy industry, particularly a battery industry for electric vehicles.

In its efforts to realise its plan, Indonesia would limit several liberalization provisions, such as the prohibition on local content requirements27, technology transfer, and the privatization of State- Owned Enterprises (SOEs). The EU has raised concerns about some of Indonesia’s protectionist policies on energy and raw materials, which would potentially hinder the critical raw materials supply to the EU needs. Several concerns from the EU on Indonesia’s policy are mentioned below in the scoping paper of the IEU CEPA:

“Indonesia’s energy and raw materials sectors present both great opportunities and challenges. Indonesia is a resource rich country, with a significant production of oil and gas as well as of minerals and metals. At the same time, Indonesia maintains a number of trade and investment restrictive measures that have a negative impact on energy and raw materials domestic and international markets. Such protectionist measures include an export ban on unprocessed minerals introduced in 2014, local content requirements, the prohibition of the privatization of SOEs in the natural resources sector as well as energy subsidies.”28

In fact, the two parties have already periodically clashed in trade disputes at the WTO. It began with Indonesia’s lawsuit against the EU for limiting market access for Indonesian palm oil products29, which was then countered by the EU’s lawsuit against Indonesia regarding the export ban of nickel ore30. Although Indonesia lost to the EU in the case of limiting nickel ore exports, Indonesia has not stopped there. In January 2023, Indonesia filed another lawsuit against the EU regarding restrictions on stainless steel products from Indonesia31.

Despite the many challenges faced by the IEU CEPA, the leaders have agreed to conclude the negotiations by the end of 202332. Three crucial issues in the IEU CEPA negotiations will determine the progress of the completion of the negotiations, namely the chapter on investment, the chapter on energy and raw materials, and the chapter on trade and sustainable development, which have influenced the nuances of the negotiations.

Very likely, the settlement of negotiations will depend heavily on trade-offs and private business deals that can be reached by both parties, especially as Indonesia hopes to attract more investment from European companies. It remains to be seen if those trade-offs will be beneficial to Indonesia’s people.

Sovereignty, democracy, and environmental justice? Some questions to ponder

While Indonesia has done much to protect its own national interests by regulating the activities of international capital and passing measures that protect local industry, that is not to say that there are no contradictions. The country still has much to do to ensure that its abundance of transition minerals does not turn into the much touted “resource curse”. There remain important questions about democratic process, questions of equity and fairness in labour practices, the protection of the local environment, and balance between the needs of business and those of the local population. In addition, other countries that have embarked on the path of nationalisation of natural resources have faced many dire consequences with capital flight, and in some cases embargoes or sanctions.

There is no disputing the imperative for countries to develop their own local industries and not lose all the profits from their mining sector through exports. There is no denying the need to create conditions that are conducive for the growth of those local industries, whether through incentives or restrictions. But the flip side to the question is, who profits the most from these policies? Do the benefits that accrue to local capital suffice for the cost to the environment and to local labour conditions? How should grassroots organisations and activists orient themselves in this fast changing landscape? How can they formulate effective, coherent and shared demands to ensure that the benefits accrue broadly to society, and not just to an internal elite capitalist class? There are already signs of this tension.

For example, Indonesia’s goal of downstream industrialisation based on natural resources requires a large scale geographic expansion of the country’s mining and processing industry. According to the Ministry of Energy and Mineral Resources as of 2021, there are a total of 339 active permits for Nickel mining business, both exploration and production, with a total area spread of 836,000 hectares. If one factors in the necessary infrastructure development through the expansion of new special economic zones established in several regions of Indonesia, as well as the development of energy sources to support this expansion, it all reads like a prescription written by the world bank33. The likelihood of environmental destruction and human rights violations raise critical questions for climate, environmental and human rights activists. Is the prospect of economic growth really worth sacrificing key social and environmental rights in the short term? Will said economic growth benefit Indonesia and propel it into a just transition, or will it only benefit the same corporations that have led us to the precipice of climate catastrophe? With these questions in mind, it is no surprise that aspects of the Indonesian government’s policy have led to internal resistance from some sectors of Indonesian society.

There is already conflict over the use of land between the government and Indonesian farmers. For example, The High-Pressure Acid Leaching (HPAL) based nickel smelter industry in the Pomala Industrial Park area, Southeast Sulawesi, which is owned by PT. Vale Indonesia in collaboration with Zhejiang Huayou Cobalt Company Limited (Huayou) has been designated as a National Strategic Project (PSN) by the Government. The National Strategic Project (PSN) enjoys protection by various forms of regulations to facilitate land acquisition, which has led to the practice of land grabbing. In 2021, for instance, the Consortium for Agrarian Reform (KPA) recorded up to 40 agrarian conflicts due to the PSN. This is over an area of 11,466.923 ha or 49.8% of the total land area required for the PSN. These conflicts are likely to increase as more mining and smelter projects are approved.

In addition to this, Indonesia’s industrialisation remains heavily reliant on foreign investment, which leads to other contradictions. At the same time that the government is angering foreign investors with the requirements for local ownership, value addition and the banning of exports, it also faces the need to attract those same investors, targeting US$ 30.9 billion as a total investment for the Battery EV supply chain industry in Indonesia34. In order to woo foreign investment to support this industrial policy, the Indonesian government passed a controversial national regulation called Omnibus Law on Job Creation that facilitates access to business licenses for foreign investors, including permits to access natural resources and to lease land. Aspects of the law also greatly undermine the country’s labour rights.

Some experts have argued in the Constitutional Court that the omnibus law on job creation is very controversial. The law has been considered procedurally flawed, especially in its efforts to deregulate dozens of laws and replace them with only a single omnibus law. Criticisms and objections came not only from labour groups, but also from environmental activists, peasant and fisherfolk organisations, students, academics from dozens of universities in Indonesia, and several leading religious organizations who see the law as detrimental to labour rights and the environment. They also say it was passed in an undemocratic process and could not be assessed by the public35.

On 25 November 2022, The Constitutional Court in Indonesia declared that the Omnibus Law is formally flawed and conditionally unconstitutional. However, The Government and the Parliament ignored the Constitutional Court’s decision and approved the omnibus law, legitimizing it in the form of government regulation in lieu of law36. Therefore, the constitutional mandate that provides justification for state control over the management of Indonesia’s natural resources also has detrimental effects for civil society and labour, and needs to be challenged in the context of its implementation. In particular, if the relationship between the state and corporations is very strong in terms of controlling business from upstream to downstream, it may limit the possibility of democratizing the energy transition for the people and for a sustainable planet. Indonesia’s civil society will have to find a way to deal will all these contradictions.

As noted in the opening of this piece, current dynamics in Indonesia and a range of other resource-holding countries therefore bring a set of key questions to the fore that are worth grappling with for social movements in Indonesia and beyond. In the context of increased geo-political and geo-economic rivalry, what are the opportunities for national industrialisation for resource-holding states (such as Indonesia) and what role is there for the state in this process? Can capital (foreign and local) be disciplined through public and democratic ownership of natural resources to play a supportive and state-directed role in such industrialisation efforts? Whether and how can extraction for the energy transition be done in a socially and environmentally just manner? Along these lines, is an extraction without, so-called, ‘extractivism’ possible? To address these questions and develop corresponding strategies will require serious and rigorous analyses and debate.

Credits : Rachmi Hertanti

source : tni.org

NOTE & SOURCE

- ‘The Role of Critical Minerals in Clean Energy Transitions – Analysis’, IEA, accessed 14 March 2023, https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-ener….

- ‘Pemerintah Pastikan 12 Januari 2014 Larangan Ekspor Mineral Mentah Diterapkan – Kementerian Koordinator Bidang Perekonomian Republik Indonesia’, accessed 23 March 2023, https://www.ekon.go.id/publikasi/detail/2831/pemerintah-pastikan-12-jan….

- ‘Pemerintah Pastikan 12 Januari 2014 Larangan Ekspor Mineral Mentah Diterapkan – Kementerian Koordinator Bidang Perekonomian Republik Indonesia’, accessed 23 March 2023, https://www.ekon.go.id/publikasi/detail/2831/pemerintah-pastikan-12-jan….

- ‘Bijih Nikel Tidak Boleh Diekspor Lagi per Januari 2020’, ESDM, accessed 23 March 2023, https://www.esdm.go.id/id/media-center/arsip-berita/bijih-nikel-tidak-b….

- The Role of Critical Minerals in Clean Energy Transitions’, n.d., 287.

- The data extracted from IEA report: ‘Global Supply Chains of EV Batteries – Analysis’, IEA, accessed 29 March 2023, https://www.iea.org/reports/global-supply-chains-of-ev-batteries.

- ‘Lampiran 1. Narasi RPJMN 2020-2024.Pdf’, accessed 22 February 2023, https://perpustakaan.bappenas.go.id/e-library/file_upload/koleksi/migra….

- Article 33 paragraphs (2) and (3) of the 1945 Constitution. Paragraph (2) states “Sectors of production which are important for the state and which affect the life of the people at large are controlled by the state”. Paragraph (3) states “Earth, water, and the natural resources contained therein are controlled by the state and used for the greatest prosperity of the people”.

- Gede Wahyu Wicaksana, ‘Economic Nationalism for Political Legitimacy in Indonesia’, Journal of International Relations and Development 24, no. 1 (March 2021): 27–50, https://doi.org/10.1057/s41268-019-00182-8.

- Article 33 of The Constitution 1945: Article 33, Paragraph 2, of the Constitution, stipulates that important sectors of production which affect the life of many people should be controlled by the state. It is followed by paragraph 3 which stresses that lands, waters and the natural wealth contained within them should be controlled by the state and used for the maximum benefit of the people. According to these constitutional mandates, the Indonesian government can and has to enforce economic sovereignty, which consists of three pillars: protection of the country’s vital national economic interests, the state’s intervention to mobilise resources for economic development, and prioritisation of the public interest over private or market interests.

- Eve Warburton, ‘Our Resources, Our Rules: A Political Economy of Resource Nationalism in Indonesia’, 2018, https://doi.org/10.25911/5d67b49938e3a.

- Localising resource nationalism aims to expand national ownership of natural resources industries at the expense of foreign investors. It involves mobilisation against foreign mining companies and policy interventions that restrict foreign ownership and compel foreign divestment.

- Industrialising resource nationalism aims to promote industrialisation of natural resource sectors. It describes mobilisation and intervention that seeks to develop new industries and stimulate the multiplier effects of raw commodity production. Typically, this involves policies that encourage value adding and downstream industrial activity through trade restrictions and beneficiation regulations. The goal is to move higher up the global value chain, by transitioning away from exporting raw natural commodities to industrialised nations, and instead produce higher value, more sophisticated products.

- Article 102 and 103 of the Mining Law 4/2009. Article 102 states “IUP and IUPK holders are required to increase the added value of mineral and/or coal resources in the implementation of mining, processing and refining, as well as utilization minerals and coal”. Article 103 states “Holders of IUP and IUPK Production Operations are required to process and refine mining products domestically”.

- Article 112 of the Mining Law 4/2009 states “After 5 (five) years of production, business entities holding IUP and IUPK whose shares are owned by foreigners are required to divest their shares to the Government, regional government, state-owned enterprises, regionally-owned enterprises, or national private enterprises

- Article 27 of the Regulation of the Minister of Energy and Mineral Resources 25/2018 states “the IUP Holders of Production Operation and IUPK Holders of Production Operation in the framework of foreign investment, since 5 (five) years after production are required to carry out a gradual divestment of shares, so that in the tenth year at least 51% (fifty one percent) of the shares are owned by Indonesian participants.”.

- Government Regulation concerning Implementation of Mineral and Coal Business Activities 23/2010 and has been updated with Government Regulation 8/2018. And, Minister of Energy and Mineral Resources Regulation concerning Mineral and Coal Business 25/2018 and has been updated with ministerial regulation 17/2020.

- “Kewajiban Pengolahan Dan Pemurnian Bahan Mineral Sesuai Konstitusi” | Mahkamah Konstitusi Republik Indonesia’, accessed 21 February 2023, https://www.mkri.id/index.php?page=web.Berita&id=10434.

- https://www.tni.org/en/publication/the-case-of-newmont-mining-vs-indonesia

- ‘Kemenperin: Newmont Cabut Gugatan Arbitrase Di ICSID’, accessed 22 February 2023, https://kemenperin.go.id/artikel/9917/Newmont-Cabut-Gugatan-Arbitrase-d….

- https://money.kompas.com/read/2017/02/21/112522526/NaN

- ‘Gugatan ISDS: Ketika Korporasi Mengabaikan Kedaulatan Negara’, Indonesia for Global Justice (blog), 12 October 2019, https://igj.or.id/gugatan-isds-ketika-korporasi-mengabaikan-kedaulatan-….

- Ha-Joon Chang, Globalisation, Economic Development, and the Role of the State, TWN & Zed Books Ltd (New York: 2003), pg. 326

- The following raw materials shall be considered strategic for the EU under the Critical Raw Materials Act: Bismuth; Boron – metallurgy grade; Cobalt; Copper; Gallium; Germanium; Lithium – battery grade; Magnesium metal; Manganese – battery grade; Natural Graphite – battery grade; Nickel – battery grade; Platinum Group Metals; Rare Earth Elements for magnets (Nd, Pr, Tb, Dy, Gd, Sm, and Ce); Silicon metal; Titanium metal; Tungsten.

- ‘European Critical Raw Materials Act’, Text, European Commission – European Commission, accessed 30 March 2023, https://ec.europa.eu/commission/presscorner/detail/en/ip_23_1661.

- ‘Can the EU Succeed on Closing Indonesia Trade Deal? – DW – 02/08/2023’, dw.com, accessed 21 February 2023, https://www.dw.com/en/can-the-eu-succeed-on-closing-indonesia-trade-dea….

- ‘Kemenperin: Pemerintah Targetkan Indonesia Jadi Pusat Kendaraan Listrik Di ASEAN’, accessed 31 March 2023, https://www.kemenperin.go.id/artikel/21279/ghs.

- See the section of Raw Materials and Energy in the Scooping Paper CEPA of Indonesia-EU, pg.16

- ‘WTO | Dispute Settlement – DS593: European Union – Certain Measures Concerning Palm Oil and Oil Palm Crop-Based Biofuels’, accessed 31 March 2023, https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds593_e.htm.

- ‘WTO | Dispute Settlement – DS592: Indonesia – Measures Relating to Raw Materials’, accessed 31 March 2023, https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds592_e.htm.

- ‘WTO | Dispute Settlement – DS616: European Union – Countervailing and Anti-Dumping Duties on Stainless Steel Products from Indonesia’, accessed 31 March 2023, https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds616_e.htm.

- antaranews.com, ‘Menko Airlangga: Perundingan IEU CEPA Diselesaikan Pada 2023’, Antara News, 21 December 2022, https://www.antaranews.com/berita/3316270/menko-airlangga-perundingan-i….

- World Development Report 2020: Trading for Development in the Age of Global Value Chains’, Text/HTML, World Bank, accessed 15 March 2023, https://www.worldbank.org/en/publication/wdr2020.

- ‘Menkomarves Catat Pipeline Investasi Hilirisasi Tambang US$ 30,9 Miliar, Berikut Daftarnya’, investor.id, accessed 31 March 2023, https://investor.id/business/315583/menkomarves-catat-pipeline-investas….

- ‘Framing-Paper-IGJ_RUU-Omnibus-Cilaka.Pdf’, accessed 15 March 2023, https://igj.or.id/wp-content/uploads/2020/04/Framing-Paper-IGJ_RUU-Omni….

- Kompas Cyber Media, ‘DPR Sahkan Perppu Cipta Kerja Jadi UU, Demokrat Interupsi, PKS “Walkout”’, KOMPAS.com, 21 March 2023, https://nasional.kompas.com/read/2023/03/21/11013191/dpr-sahkan-perppu-….